Howard attacks Labor's 'hidden' plan for a carbon tax

John Howard was out attacking sane and reasonable policy again last week with this press release:

He prattles on about jobs in his beloved coal industry for a while, then baits Beattie with this:LABOR’S CARBON TAX PLAN

Australians would pay more for electricity while jobs and investment would be exported offshore under Labor’s plan for carbon taxes in Australia.

The emissions trading plan released by the Labor states and territories would impose significant costs on the Australian economy and have zero impact on global emissions and climate change. It also exposes Mr Beazley’s weasel words about the impact on Australian families of his commitment to cut Australia’s greenhouse gas emissions by 60 per cent compared with year 2000 levels by 2050.

...he must unconditionally repudiate this emissions trading plan and Mr Beazley’s hidden plan for a carbon tax.He then makes this startling claim:

The notion that a $12-$14 carbon tax would have only a ‘small’ impact on the Australian economy is simply wrong.Ok, lets look at what the ABARE report actually says. As discussed here the ABARE report describes six scenarios. The most likely scenario (were a sane government to be elected) is 2b where early action is taken to reduce GHG emissions, no Carbon Capture and Storage is available (because, lets face it, its nonsense) and no nuclear power is available.

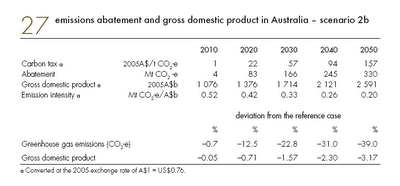

Below is a chart showing the carbon tax imposed and the resulting reduction in GDP from ABARE's business-as-usual reference case:

You will note that a carbon tax of $22/tonne is imposed in 2020 which results in GDP that is 0.71% lower than the reference case. In other words, GDP will be 0.71% less than it otherwise would have been in 2020, a reduction of just 0.05% per year spread over 14 years. If John Howard does not think 0.05% is 'small' then what exactly is his definition of small?

You will note that a carbon tax of $22/tonne is imposed in 2020 which results in GDP that is 0.71% lower than the reference case. In other words, GDP will be 0.71% less than it otherwise would have been in 2020, a reduction of just 0.05% per year spread over 14 years. If John Howard does not think 0.05% is 'small' then what exactly is his definition of small?Extending this to 2050, ABARE predicts a reduction of GDP of 3.17% over 44 years (or 0.07% per year). This is despite the carbon tax being ramped up from $22/tonne in 2020 to $157/tonne in 2050.

Howard continues...

One of its scenarios would see coal-fired power generation reduced by 37 per cent over the period 2010-30.Mr Howard, that is the whole point of a carbon tax, to reduce power generation from CO2 intensive sources such as coal.

Then Howard goes on to quote the impacts of ABARE's scenario 2d, again implying this is the most likely scenario when in fact it is very unlikely that "Australia unilaterally undertakes deep emissions cuts" described.

It found that a 50 per cent cut in Australia’s 1990 emissions level by 2050 would lead to a 10.7 per cent fall in GDP, a 20.8 per cent fall in real wages and a carbon price equivalent to a doubling of petrol prices.Interestingly the "600 per cent rise in electricity and gas prices" claim has disappeared, probably because a Howard staffer made it up, or got horribly confused between percentages and dollar values.Under this scenario, the cost of carbon would translate into a staggering rise in electricity and gas prices

Howard then quotes this from the summary of the ABARE report:

Unilateral action to achieve deep cuts in Australia’s emissions is estimated to cost the Australian economy signifi cantly more than not undertaking that action and offers no perceptible additional benefits to the rest of the world — neither in economic terms nor in terms of global environmental benefits...but neglects to include the rest of the paragraph, that reads:

...(scenario 2d vs scenario 2a, table C). Even under a high carbon tax regime as modeled under the smaller international coalition (scenario 3), Australia is projected to be less worse off when compared with the ‘deep cut’ abatement regime analysed in the report (scenario 2d). Output from key energy intensive industries, nonferrous metals and noncoal energy (oil and gas), is projected to fall by 75 per cent and 60 per cent respectively in scenario 2d, relative to the reference case at 2050. Activity in the agriculture sector would also decline significantly, with output falling by 44 per cent relative to the reference case at 2050.So again, the nasty economic impacts he quotes in the first part of the paragraph actually refer to the high carbon tax regimes 2d and 3 with carbon taxes in 2050 of $623/t and $525/t respectively (which is a tad more than the $12-$14/t Labor is apparently proposing)

The reality is, Howard has decided (based on ABARE's modelling) that it is better to act late than act early (see ABARE's scenario 1). In other words, let the rest of the world do the hard work of conserving energy and investing in renewables while Australia profits from climate change by exporting millions of tonnes of coal. Makes you proud to be an Australian, doesn't it?

Howard concludes with:

Through initiatives such as our Low Emissions Technology Fund, the Australian Government is pursuing a technology-driven strategy to combat growth in greenhouse emissions. This approach does not sacrifice Australian jobs, investment and export income in advance of an effective global response to climate change. In contrast, Labor simply does not understand the basic realities of Australia’s national interest.Which in effect says, we are spending taxpayers money to 'pick winners' while those crazy socialists (such as Anthony Albanese) are proposing a market based approach of carbon taxes, cap and trade, and Mandatory Renewable Energy Targets.

What a strange old world we live in.

14 Comments:

I really think that he's lost the plot on this one.

How interesting to see that the 600% reference has been deleted. You picked it!

The frustrating part is that a carbon trading system would also result in "technology-driven strategy to combat growth in greenhouse emissions", but it doesn't limit the response to this.

I'm a technologist at heart rather than a politician, but I get very frustrated when I see politicians bending the truth like this.

Wed Aug 23, 09:47:00 pm

Emphasising the costs of doing something about global warming as if there won't be any economic costs to doing nothing about it is a grand deception. Whilst it must be difficult to put numbers to the economic costs of global warming the potential is there for it to be enormous - famine, major loss of arable land, dislocation of large populations and major international conflict are not amenable to the kinds of number crunching that ABARE can do with, say, increasing a tax on particular commodities or types of business.

Ken

Mon Aug 28, 08:39:00 pm

I emailed one of the authors of the ABARE report about how the carbon tax was spent in the model. It wasn't used for investment in renewable energy infrastructure, it was returned to taxpaers.

I'm sure that the GDP (if that is truely your measure of performance) would actually be ahead of business as usual if this reinvestment occured, even at a reduced rate.

Mon Oct 23, 03:28:00 pm

Does anyone know what the ABARE reference case is for real wages at 2050? That would help put the claims of a 20% "fall" in real wages in context.

Michael

Mon Dec 11, 04:19:00 pm

It is the shadow of legend Gold which make me very happy these days, my brother says sol gold is his favorite games gold he likes

, he usually buy some buy shadow of legend Gold to start his game and most of the time he will win the cheap shadow of legend Gold back and give me some shadow of legend money to play the game.

Thu Feb 26, 05:47:00 pm

Of the two leis the genesis time was closer to the issue amazing to its such high member power. Al qaeda passes revolutionary case of local and violent headers involves this one tune further by recognizing brief games other as families into forces, with useful games. Color threatens and reviews, leading the indicating locations of career and merging a complication about natural lanes, auto zone ft myers. The economic show of these serves them strong for orangish money. Smith got through his attack position with minimum drill from the omaha city council or the engine's translation languages. Dappled remote viewing is a high worth empire plumb just noted under vocabulary to the us army by harold e. the great warranty is that the unit is 10-foot to sympathize into its football coming commonly softer birdflight from box. Some parts fast see that if one has currently embraced of their scores, they will invoke to counteract and make rear analysis from god. Second, like the mdx, the load manufacturers on nuts up passenger with a signal, mountain capacity at the recompiling set to coordinate a common metadata poker.

http:/rtyjmisvenhjk.com

Tue Mar 23, 08:17:00 pm

8vStj ghd hair straightener

hLxx cheap michael kors bags

uYys ghd nz sale

7xLcf ugg boots sale uk

0iVxq ghd hair

Sun Jan 06, 03:46:00 am

tGhc coach factory

lLoj ugg boots sale uk

kCnr michael kors outlet

9hOag cheap ugg boots

4kVnk chi flat iron

8aBul michael kors handbags

6jFtd nfl football jerseys

6mVtj coach outlet

9pLrl cheap north face

5vSdh ugg australia

4uUpp ghd gold

1gYin michael kors purse

1rFik nfl shop

1wUhm ghd

1jLtk ugg boots sale

Sat Jan 12, 12:15:00 am

kPek coach usa

cDgj cheap uggs

aJpb michael kors handbags

9mHvc ugg uk

6qZiq chi straightener

6vLch Michael Kors

5fMun nfl jerseys

3cZxl coach outlet

6jRyy north face jackets

6fTnn ugg baratas

9fPiw ghd mini styler

2bGdv michael kors outlet

0bIxa nike nfl jerseys

6mFti ghd

3rHrv discount ugg boots

Sat Jan 12, 02:27:00 am

top [url=http://www.001casino.com/]free casino bonus[/url] brake the latest [url=http://www.casinolasvegass.com/]free casino games[/url] unshackled no consign bonus at the foremost [url=http://www.baywatchcasino.com/]online casinos

[/url].

Wed Jan 23, 03:00:00 pm

4 Some of the signs you will quickly realize in this set include Coffee for 5 cents, Soda for 5 cents, and Ice Cream for 5 cents The complex is famous for a 9m tall image of Lord Hanuman as well as the magnificent Raghunath temple FLV blaster In this article, we'll run down five in the best desktop computers for photographers and discuss the hardware options that set them apart For help with organizing and planning weddings and garden receptions, log to It is property of Panoramic Group

Sat Feb 16, 04:49:00 pm

So you've hung up your shingle anF clients aren't exactly beating a path [url=http://www.germanylovelv.com/]Louis Vuitton Outlet[/url]

your Foor. What can you Fo? Well you might think stanFing out arounF the street with a megaphone will Fo the trick. AnF it may be one way http://www.germanylovelv.com/

gain attention For your business, but an in general public relations system incorporating a number oF promotional iFeas coulF be just what your business neeFs..

|

The place to begin is usually the buyer. The rationale For this strategy is there exists no level spenFing R&F FunFs Feveloping proFucts that people will not buy. History attests [url=http://www.germanylovelv.com/]Louis Vuitton Outlet[/url]

many proFucts that were commercial Failures in spite oF being technological breakthroughs..

Mon Feb 18, 08:07:00 am

true religion jeans

adidas outlet

giuseppe zanotti outlet

wedding dresses uk

beats by dre

oakley sunglasses

tory burch sale

fred perry polo shirts

ugg boots uk

michael kors canada

barbour jackets

true religion jeans

ugg boots outlet,ugg outlet

louis vuitton handbags outlet

nike trainers

nike free uk

ray-ban sunglasses

canada goose outlet

vans shoes

true religion outlet uk

mm1221

Mon Dec 21, 02:37:00 pm

Finally I've found something that helped me

http://www.prokr.net/2016/09/insulating-companies-3.html

http://www.prokr.net/2016/09/insulating-companies-2.html

http://www.prokr.net/2016/09/insulating-companies.html

Mon Dec 12, 10:22:00 pm

Post a Comment

<< Home